|

|

为让大家更方便的阅读老方的文章,老方把自己的文章做了一下汇总,分为

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之房产篇

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之教育篇

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之医疗篇

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之交通篇

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之生活常识篇

卡尔加里老方:【收藏】加拿大卡尔加里全攻略之吃喝玩乐篇

等系列送给大家,如有新文章会及时更新,收藏即可:)

卡尔加里4月3日讯:

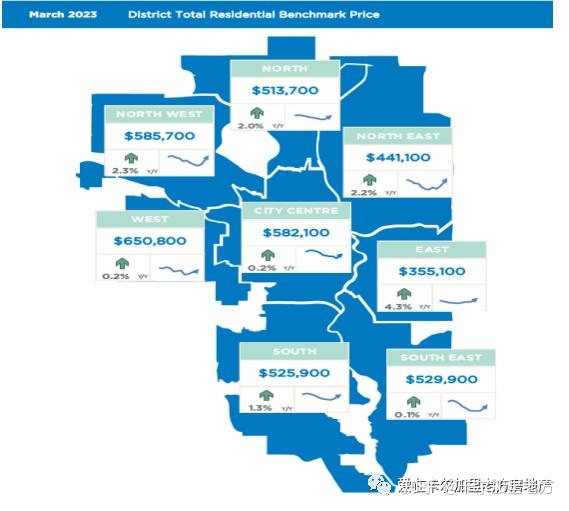

(卡尔加里3月各区涨幅情况表)

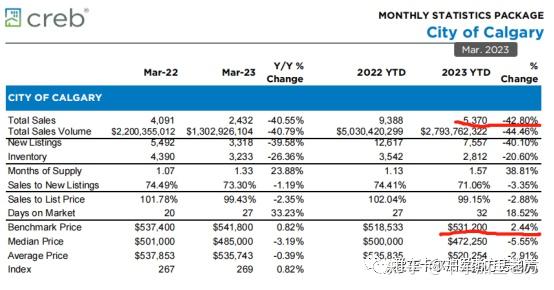

3月销量和新上市房源较年初报告的水平有所提高。因此,月度库存量有所提高。然而,3233套新挂牌量仍旧是自2006年以来3月库存的最低水平,房屋供应月数仅1个月多一点,仍是妥妥的卖方市场。虽然情况没有去年3月那么紧张,但低库存量使购买者的选择有限,再次推动了房价的上涨。

3月份卡城住宅基准价格达到54.18万元,比上个月增长2%,比去年报告的价格高出近1%。虽然价格仍然低于2022年5月的高点54.6万元,由于持续的卖方市场,第一季度的价格增长速度比预期的要强。

卡尔加里地产经纪协会首席经济师Ann-Marie Lurie说:"正如预期的那样,由于最近新移民的增加扩大了对房屋的需求,销售虽然已经从创纪录的水平上缓和下来,但仍然比疫情之前要强。

"挑战仍旧集中在供应方面。现有房产的房主可能不愿意上市,因为他们很难在这个市场上再找到可接受的住房。与此同时,更高的贷款利率也会降低现有房主将房屋挂牌出售的积极性。”

3月份的新挂牌量为3318套,销售量为2432套,挂牌成交率为73%。 然而,与去年3月报告的水平相比,销售量和新上市量都下降了40%。

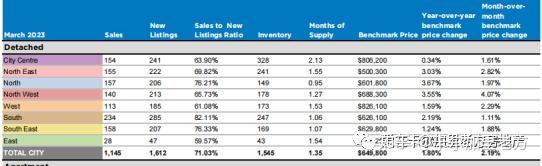

独立屋

Detached

较低的挂牌量和较高的贷款利率导致了独立屋销售的急剧回落。

这个月的销售量为1145套,是唯一低于长期趋势的房产类型。然而,尽管销售量下降,库存水平仍然与2006年3月的最低水平相当。

(独立屋新挂牌量较低)

持续紧张的市场环境促进了价格的进一步增长。在3月份,独立屋的基准价格达到了64.98万元的新纪录。由于供应水平的转变,低价房源变得更加稀少。今年到目前为止,近63%的新上市房源价格超过60万元,远远高于去年报道的48%。

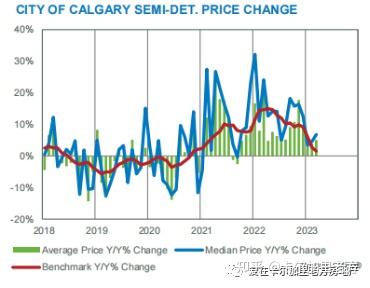

双拼

Semi-Detached

与其他类型的房产一样,双拼屋销售和新上市的房源都比去年同期水平大幅下降,使得该板块市场异常紧张,3月份的挂牌成交率为78%。此外,较高的贷款利率促使许多购房者开始寻求双拼屋房产。然而,价格低于60万的房产的需求仍然异常紧张。

相对于市场上的销售情况,低库存量推动了本月双拼屋价格的进一步上涨。因此,3月份双拼屋的基准价格达到58.13万元,比2月份高出2%,比去年的同期水平也高出近2%。然而,尽管在过去几个月里涨势强劲,但基准价格仍未达到2022年5月创下的58.47万元的月度高点。

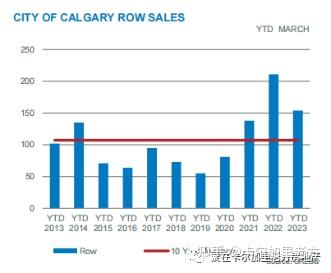

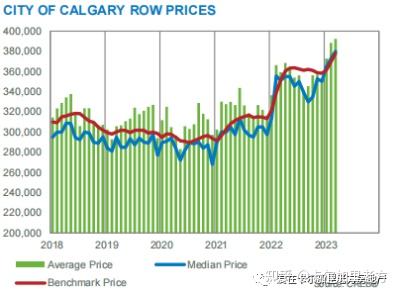

联排

Row

虽然与今年年初的水平相比,排屋销售、新上市房源和库存水平与年初相比都呈上升趋势,但与其他房产类型一样,水平远低于去年。目前市场情况仍然有利于卖家,紧张的市场条件也给价格带来了进一步的上升压力。

在3月份,联排基准价格上升到37.81万,价格比去年同期增长近8%,价格创月度新高。其中东北区和南区的价格增长最为强劲,而西区的同比涨幅最低。

公寓

Apartment Condominium

3月份报告的公寓销售量为682套,比去年的最高纪录下降了11%。新挂牌房源也比去年减少了8%,使库存水平保持在1000套的相对低位。与销售相比,房屋供应月数低于两个月,使得市场继续有利于卖方。

卡尔加里的公寓基准价格达到29.35万元,同比增长近11%。最近的价格上涨使公寓市场价格接近全面复苏。公寓价格的历史高点是2014年11月:30.66万元。

区域市场情况

艾尔德里Airdrie

3月份有154套销售和203套新挂牌,挂牌成交率推高到76%,库存水平下降到2014年以来的最低水平。虽然情况没有去年那么紧张,但供应数量确实下降到了八个多月以来的最低水平。自2021年1月以来,艾尔德里的供应量仍旧紧张,到目前为止,持续的紧张状况导致房产价格与2022年底的水平相比呈现再次上升的趋势。

3月份,基准价格达到49.74万元,比上个月增加了2%。尽管最近有所改善,水平比去年低了近2%,但仍然低于2022年4月报道的51.07万元的月度峰值。虽然价格仍然低于去年的峰值,但重要的是让我们了解到了价格较过去几年上涨了多少。截至3月,基准价格比2021年3月报告的水平高出20%以上。

科克伦 Cochrane

虽然销售和新上市的房产都比过去几个月的水平有所提高,但仍然比去年报告的高水平低得多。此外,与其他地区不同,科克伦目前的库存水平高于去年同期水平。然而,3月份只有155套,销售量为87套,房屋供应月数再次下降。

连续第二个月,住宅基准价格比上个月有所上升,达到50.19万元。尽管每月都有增长,但价格仍然略低于去年的水平,以及2022年6月达到的月度最高价52.26万元。与艾尔德里一样,该地区的价格在过去几年中大幅上涨,比2021年3月报告的水平高出20%以上。

奥科托克 Okotoks

销售量和新房源较今年早些时候的水平有所改善。然而,有55套销售和67套新挂牌,供应条件仍旧异常紧张,3月份有61套可供出售,是该月有记录以来的最低水平之一。 在2020年3月疫情大流行之前,Okotoks通常会有200多套可用库存。

目前供应条件继续有利于卖方,使得对价格施加了上行压力。在连续三个月的价格上涨之后,3月份,基准价格达到56.16万元,创下该地区的历史新高。

常用房地产统计术语:

挂牌成交率(the sales-to-new listings ratio):给定期间的当前销售套数对比新上市套数,一般采用过去30天的数据。此比率一般是一个百分数,如果在40-60%之间,代表市场比较平衡,如果高于60%,一般指卖方市场,如果低于40%,一般代表买方市场。

房屋供应月数(Months of Supply):给定时间段(通常是过去30天)结束时库存总数除以同一时期结束时的销售总数。库存月数是房屋供求平衡的另一重要指标。它代表以目前的销售活动完全清算当前库存需要多长时间。

CREB®Link News

Media release: Prices rise as conditions favour the seller

by CREB® on April 03, 2023

City of Calgary, April 3, 2023 - Sales and new listings have improved over the levels reported at the beginning of the year. As a result, the spread between sales and new listings supported some expected monthly inventory level gains. However, the 3,233 available units reflected the lowest March inventory levels since 2006 and left the months of supply just above one month, firmly in the seller’s territory. While conditions are not as tight as last March, low inventory levels leave purchasers with limited choice, once again driving up home prices.

Total unadjusted residential home prices reached $541,800 in March, a two per cent gain over last month and nearly one per cent higher than prices reported last year. While prices remain below the May 2022 high of $546,000, the pace of price growth over the first quarter has been stronger than expected due to the persistent seller’s market conditions.

“As expected, sales have eased from record levels while remaining stronger than they were before the pandemic thanks to recent gains in migration supporting demand,” said CREB® Chief Economist Ann-Marie Lurie.

“The challenge has been centered around supply. As a result, existing homeowners may be reluctant to list as they struggle to find an acceptable housing alternative in this market. At the same time, higher lending rates can also reduce the incentives for existing homeowners to list their home.”

March recorded 3,318 new listings compared to the 2,432 sales, leaving the sales-to-new listings ratio relatively high at 73 per cent. However, both sales and new listings have eased by 40 per cent compared to levels reported last March.

Detached

Lower listings and higher lending rates have contributed to the steep pullback in detached sales. With 1,145 sales, this is the only property type where activity has fallen below long-term trends for the month. However, despite the drop in sales, inventory levels remain comparable to the lowest March levels recorded in 2006.

The persistently tight market conditions have contributed to further price growth. In March, the detached benchmark price reached a new record high at $649,800. Conditions are much tighter at the lower end of the market as supply levels have shifted. Nearly 63 per cent of the new listings that have come onto the market so far this year are priced over $600,000, much higher than the 48 per cent reported last year.

Semi-Detached

Like other property types, sales and new listings reported a significant drop over last year’s levels, leaving the market exceptionally tight with a sales-to-new listings ratio of 78 per cent in March. In addition, higher lending rates have driven many purchasers to seek semi-detached properties. However, conditions remained exceptionally tight for properties priced below $600,000.

Low inventory levels relative to the sales in the market drove further price gains this month. As a result, the unadjusted benchmark price reached $581,300 in March, over two per cent higher than last month and nearly two per cent higher than last year’s levels. However, despite the strong gains over the past several months, prices remain shy of the May 2022 monthly high of $584,700.

Row

While row sales, new listings and inventory levels have all trended up compared to levels seen at the start of the year, like other property types, levels are much lower than last year. With one month of supply available, conditions continue to favour the seller. The tight market conditions also placed further upward pressure on prices.

In March, the benchmark price rose to $378,100, reflecting a year-over-year gain of nearly eight per cent and representing a new monthly record high. Price growth was strongest in the city’s North East and South districts, with the lowest year-over-year gains occurring in the West district.

Apartment Condominium

March reported 682 apartment condominium sales, a decline of 11 per cent over last year’s record high. New listings also eased by eight per cent compared to last year, keeping inventory levels relatively low at 1,000 units. The low inventory levels compared to sales kept the months of supply well below two months, ensuring the market continued to favour the seller.

The benchmark price in Calgary reached $293,500, a year-over-year gain of nearly 11 per cent. The recent increase in price is shifting this market closer to full price recovery. For example, apartment condominium prices reached a monthly high back in November 2014 at $306,600.

<hr/>REGIONAL MARKET FACTS

Airdrie

With 154 sales and 203 new listings in March, the sales-to-new listings ratio pushed up to 76 per cent, and inventory levels fell to the lowest levels for the month since 2014. While conditions are not as tight as they were last year, the months of supply did fall to the lowest level seen in over eight months. The months of supply in Airdrie has not risen above two months since January 2021, and the persistent tightness so far this year has caused prices to trend up again compared to levels seen at the end of 2022.

In March, the benchmark price reached $497,400, a two per cent gain over last month. Despite the recent improvements, levels are nearly two per cent below last year’s and still below the monthly peak of $510,700 reported in April 2022. While prices are still lower than last year’s peak, it is important to keep a perspective on how much prices have risen in this market over the past several years. As of March, the benchmark price is over 20 per cent higher than the levels reported in March 2021.

Cochrane

While both sales and new listings have improved over levels seen over the past several months, they are still much lower than the high levels reported last year. In addition, unlike other areas, inventory levels are higher than the low levels reported in the previous year. However, with only 155 units available in March and sales of 87, the months of supply has once again fallen below two months.

For the second month in a row, residential benchmark prices increased over the previous month reaching $501,900. Despite the monthly gain, prices are still slightly lower than last year’s levels, and the monthly high achieved in June of 2022 at $522,600. Like Airdrie, prices in the area have risen significantly over the past several years and are over 20 per cent higher than levels reported back in March 2021.

Okotoks

Sales and new listings have improved over levels seen earlier this year. However, with 55 sales and 67 new listings, conditions remained exceptionally tight, and with 61 units available in March, levels were amongst the lowest levels ever recorded for the month. Before the March 2020 pandemic, Okotoks would typically see over 200 units available in inventory.

With one month of supply, conditions continue to favour the seller placing upward pressure on prices. After three consecutive months of price gains, in March, the benchmark price reached $561,600, a new record high for the area.

版权声明:【除原创作品外,本公众号所使用的文章、图片、视频及音乐收集整理于网络,其版权属于相关权利人所有,只为方便卡城华人,如存在不当使用的情况,敬请相关权利人随时与我们联系及时处理。】

如果觉得文章有帮助,把它分享出去,帮助更多的人,

|

|